Current and Future Market Conditions Q2 2017

Statistically, Q 2 brought little to no changes from Q 1. There were a lot of announcements and renewals, but very little changed. The Central Business District (CBD) witnessed nominal positive absorption of 50,000 SF. 3.25 million SF is still available and the vacancy rate is 8.6%.

New Leases:

- The Environmental Protection Agency renewed 310,000 SF for an additional two years at 1650 Arch Street.

- Jacobs Engineering renewed 50,000 SF at 2301 Chestnut Street.

- Brandywine Global peaked its head out of Cira Center, searching for 70,000 SF. Mellon Bank Center will be their new home leasing floors 16-18 for ten years.

Jazz Pharmaceuticals Renewed 22,00 SF in One Commerce Square and relocated an additional 22,000 SF from 1818 Market St for 10 years in One Commerce SQ as well.

In the Market:

- With a lease scheduled to expire in 2020, Willis Towers Watson is seeking to considerably reduce its existing footprint from 275,000 SF to 125,000 SF.

- Deloitte plans to downsize from 125,000 SF in 1700 Market St to 75,000 SF.

- McCormick Taylor & Associates is searching for 60,000 SF.

- Post & Shell, located at 4 PC, is considering relocation options for 60,000 SF.

- Willig, Williams & Davidson hopes to leverage an early termination option on 40,000 SF located at 1845 Walnut St.

- Gordon& Rees is exploring alternatives outside of One Commerce Square for 25,000 SF.

- Jefferson Health System plans to consolidate numerous office spaces into one centralized location with 300,000 SF at 1101 Market St rumored to be the location.

- Wells Fargo is exploring alternatives other than 123 S Broad St for 125,000 SF.

Noteworthy Points:

- Statistically, rental rates remain healthy on the surface: i) Trophy Class space priced at $39.00/SF, ii) Class A space inched upwards to $29.00/SF, iii) Class B space priced at $25.00/SF, and iv) Class C space priced at $22.50/SF.

While asking rates remain at an all-time high, Q2 brought about change that is detrimental to landlords. Recent transactions are taking place 12%-13% below asking rates and represent a significant change from the historically more common rate of +/- 8%. The explanation for this change becomes apparent when one examines the current market dynamics more closely as demonstrated by the chart & appendix below.

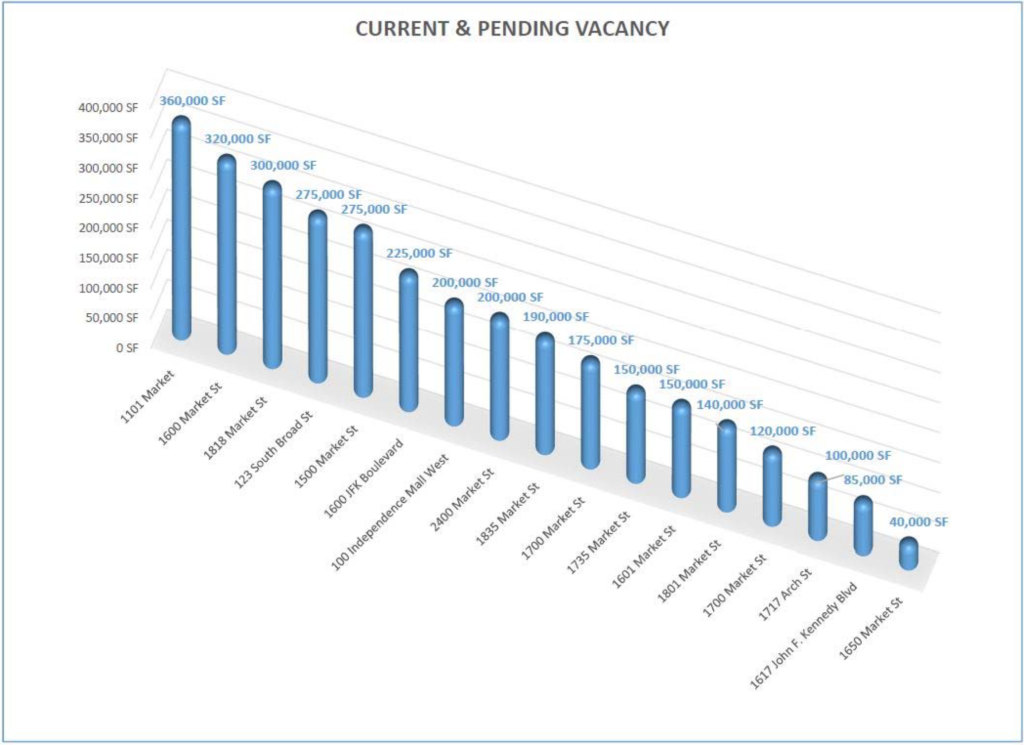

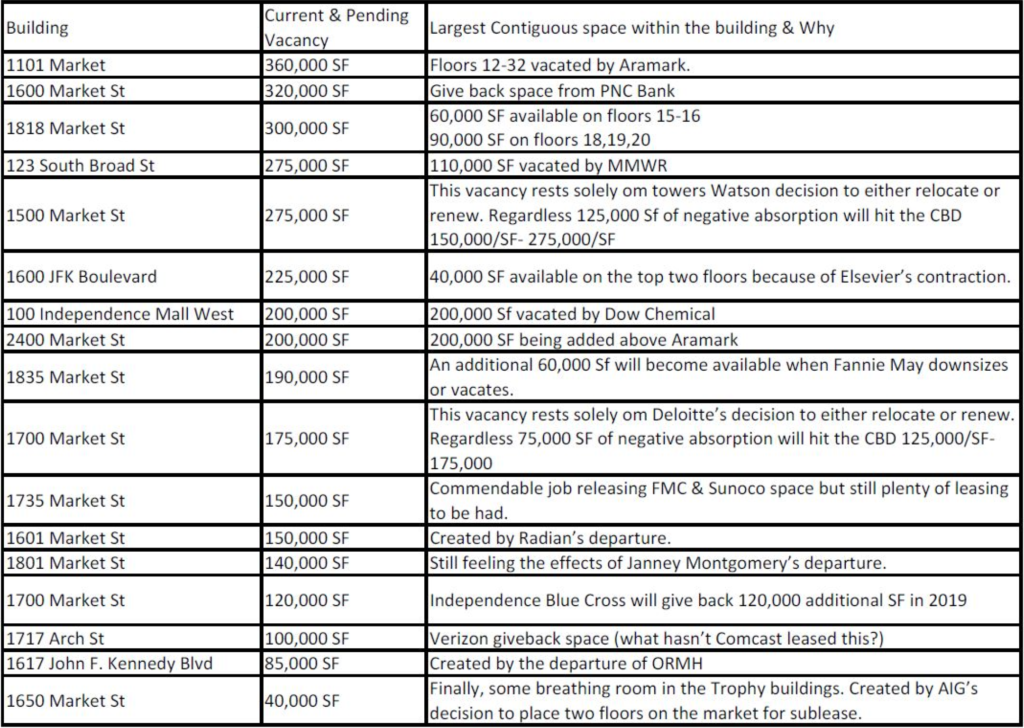

With the flurry of activity in the CBD over the previous 60 months, important data trends (graphic below and Appendix A) have gone unnoticed. Nobody likes to discuss “shadow space” or “shadow vacancy” (future space that has not yet become vacant, but is destined to become available). This graphic portends a “clear and present danger” to the landlords’ recent favorable run:

See appendix A for more in depth details on current and pending vacancies.

Tenants seeking renewals and new leases in Trophy assets should not anticipate much, if any, relief given the low vacancy rate. In class A buildings, however, I anticipate tenants may potentially realize significant concessions except for those tenants seeking office space above the 25th floor, where vacancies are essentially nonexistent. If anything, I would not be surprised if Trophy rents inch upward and the delta between Trophy assets and Class A buildings increases. In the Class A buildings, once a few vacancies materialize, pressure will mount on Class B assets to retain their existing tenants and thereby prevent another “flight to quality” that was so very prevalent throughout 2009-2013.

Looking forward, asking rates will likely remain artificially inflated for the foreseeable future (except Trophy Assets). However, tenants that allow adequate time (15-18 months) to address their pending requirement should be able to leverage market alternatives and enjoy many of the same tenant favorable concessions that were realized by tenants earlier in the decade.

Appendix A

CLICK HERE to Download the Quarterly Report

No Adobe Acrobat PDF Reader? Download HERE.